Understanding Business Valuation

The first question a business owner asks when considering a sale of their company is always, “How much is my business worth?” The truth is that to answer this question in a meaningful way, itRead more

The first question a business owner asks when considering a sale of their company is always, “How much is my business worth?” The truth is that to answer this question in a meaningful way, itRead more

Check out our latest newsletter here: March 2024 In this month’s issue: Large M&A rebounds – what does this mean for UK SMEs Life after Sale – listen to one business owner’s story The importanceRead more

EvolutionCBS has partnered with a well-established corporate finance team comprising Michael Simson, Pradip Somaia, Brett Stacey, Dolf Campman and James Calvert. This team have separated from Regent Assay and will now trade as Regent EvolutionRead more

Issuing any dealmaking predictions for Q2 and Q3 2024 is a precarious occupation. As things stand, Britain and Europe as a whole are still subject to the economic headwinds caused by peak inflation, and theRead more

Large M&A picks up in 2024 – what does this mean for UK SMEs An article from S&P Global Market Intelligence had some rather better news about MA& activity! January marked the second straight monthRead more

Twelve years ago today I joined EvolutionCBS, a sell-side M&A Consultancy. Looking back over these years it’s been fun remembering many things, some frustrating – for example, I was a size six then (and IRead more

During the process of selling a business, usually at the stage where the seller is in exploratory discussions with the shortlist of potential buyers, one of the considerations is how the two parties assess theRead more

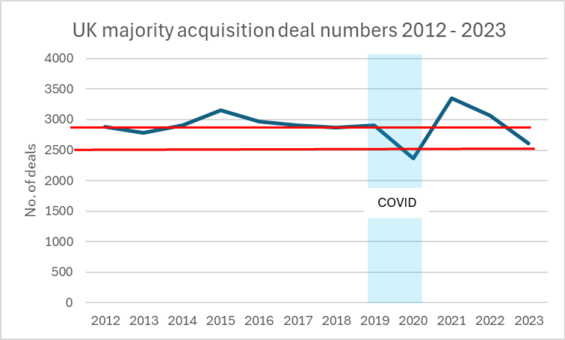

Much of the macroeconomic news at present appears to be gloomy, so Directors/Shareholders would be wise to give serious consideration to the timing of any company sale. What is absolutely clear is that Deal MakersRead more

Despite the economic turbulence that has prevailed for much of 2023, the M&A market has fared better than had been expected. However, there is a qualification needed here. There has been a marked drop inRead more

“When considering your ‘exit flight’ from the business, there’s a danger that the ‘weight’ of owner reliance – far from securing the ‘smooth take off’ you’d hoped for – might only lead to a fatalRead more

Company owners/Shareholders frequently ask the question “How much is my business worth?” However, an equally important question might be “How can I build future Equity Value into the business?” While the answer to this questionRead more

For any business owner considering a future sale it is vital to understand the different motivations of trade and financial buyers. In our previous post about ‘exit strategies’, we discussed, very briefly, two different typesRead more

Dear visitor. Please subscribe if you'd like to receive updates and events on selling or buying a business