8 reasons to prepare early for a business sale

Like many things, preparation is the key to success. The same is true for business owners that want to take a full or partial exit from their companies. In tougher economic times, when it’s aRead more

Like many things, preparation is the key to success. The same is true for business owners that want to take a full or partial exit from their companies. In tougher economic times, when it’s aRead more

‘Received wisdom’ in the world of mergers and acquisitions suggests that business owners that want to sell should seek a full exit from their business, but what about the shareholder that chooses to remain activelyRead more

There’s no hiding from the fact that uncertainty in the UK economy has caused a reduction in the volume of M&A deals done in the last quarter of 2022. Nevertheless, strategic acquisitions offer one ofRead more

Most people would agree that there’s almost always a difference between the price a vendor would like to achieve and the price a buyer would like to pay. In the case of a business saleRead more

For most owners, having invested significant time and effort into a sale, accepting an offer and entering Due Diligence is usually the moment where the finish line has finally come into sight. That said, itRead more

You would think after negotiating and accepting an offer to purchase your company that the hard work is over. Far from it! In reality, the hard work is just beginning, in the form of DueRead more

The European developed markets attract massive investment from Private Equity/VC buyers and the UK is one of the region’s most popular. Despite the ongoing impact of economic volatility, in H1 2022 the UK saw theRead more

Selling a business can be an intense and demanding exercise, which doesn’t leave a lot of room for business owners to think about life post-sale. Yet having a clear idea of what you want toRead more

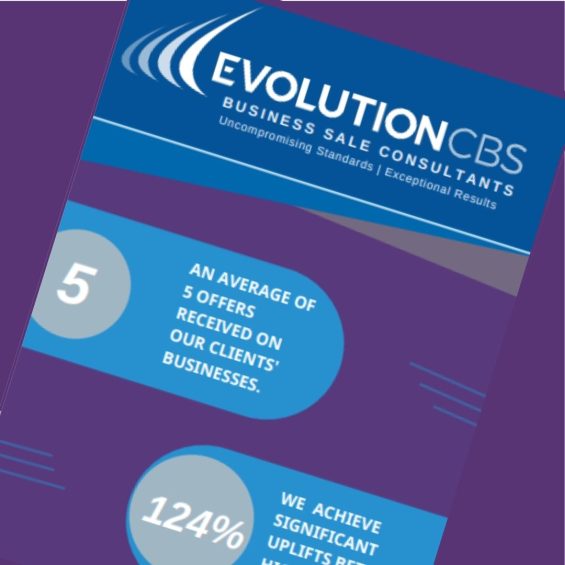

What sets us apart from the competition? It’s our consulting and advisory service provision where proactivity is the order of the day. Ultimately, our track record of deals evidences our key differentiators, with a ‘brokerage-style’Read more

When attempting to sell a company, it will always be better to have a number of potential acquirers interested in your business, submitting competitive offers to give the departing shareholders a ‘choice’ of exit options.Read more

Selling a business in the current macroeconomic environment requires more than the usual offering that most company sale brokers bring to the table. It needs new proactive approaches, including courting interest from a variety ofRead more

European Raid Arrays Ltd (ERA), a provider of cloud infrastructure-as-a-service solutions is now set to benefit from an injection of significant growth capital following discussions with Private Equity firm Rockpool Investments, in a transaction managedRead more

Dear visitor. Please subscribe if you'd like to receive updates and events on selling or buying a business